What is fund accounting?

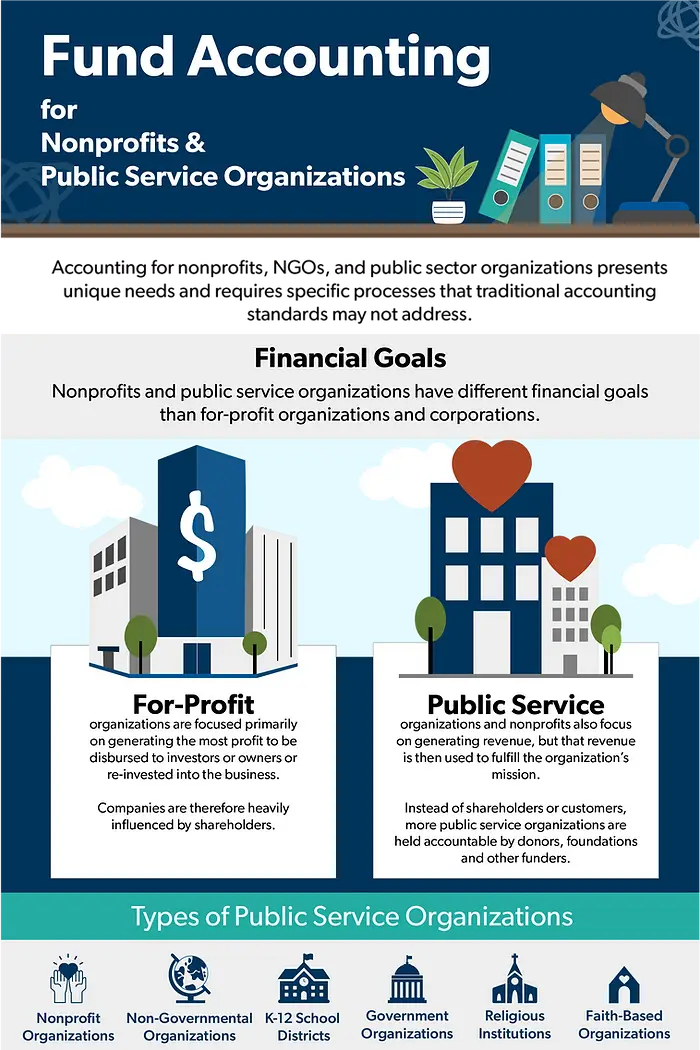

Accounting for nonprofits, NGOs, and public sector organizations presents unique needs and requires specific processes that traditional accounting standards may not address.

Financial Goals

Nonprofits and public service organizations have different financial goals than for-profit organizations and corporations.

For-profit organizations are focused primarily on generating the most profit to be disbursed to investors or owners or re-invested into the business. Companies are therefore heavily influenced by shareholders.

Public Service organizations and nonprofits also focus on generating revenue, but that revenue is then used to fulfill the organization’s mission.

Instead of shareholders or customers, more public service organizations are held accountable by donors, foundations and other funders.

How is accounting different for these types of organizations?

One of the primary differences is the types of revenue that nonprofits and public service organizations collect and track.

Restricted vs. Unrestricted Funds

The other major difference between accounting for for-profit companies and not-for-profit organizations is restricted versus unrestricted funds.

Unrestricted funds can to be used for any type of expenditure, including:

- Mission activities

- Staff salaries

- Employee training

- Rent and occupancy costs

- Software and hardware

Restricted Funds can only be used for the express purpose the funder has set. Some examples include:

- A foundation does not allow its funds to be used for overhead expenses

- Community Foundation requires funds to stay local

- Donors want to fund a specific mission activity or research area

- Government grants tied to specific activities

Restricted funds must be tracked differently to ensure it goes to the specified expenditure and to ensure organizations can meet reporting guidelines required by the funder. This specific process of accounting is called Fund Accounting.

SylogistMission ERP is a pioneer in fund accounting solutions for nonprofits, NGOs, K-12 Schools, Government, faith-based and religious institutions.

Learn more about SylogistMission ERP.

Learn more about fund accounting with our free infographic:

Additional Resources

Blog Posts

Sylogist News