A Nonprofit's Essential Guide to Accounting Software

Although the most popular accounting software products- like QuickBooks and SAP- handle the needs of businesses in many industries, nonprofits have a unique business model and accounting standards and require different features and functionality from accounting software.

Keep reading this Essential Guide to Nonprofit Accounting Software to learn what makes accounting for nonprofits unique and get tips on choosing the best accounting software for your organization.

How are Nonprofit's Financial Goals Different?

How is Accounting Different for Nonprofits?

Nonprofits have assets but instead of owners having equity in the balance sheet, net assets are tracked for a nonprofit. Unlike a business’s revenue, these assets either have donor restrictions or they are considered unrestricted funds. Restricted funds can only be used for specific types of work- like direct services to constituents or they must focus on a specific category of work within a nonprofit’s mission.

Almost all organizations produce some sort of annual financial reporting, but it may not always be public information. Donor and granters both expect detailed reporting and deep financial transparency from nonprofit organizations. To efficiently provide this information, nonprofits need detailed financial records and real-time data to help gauge their progress towards their financial goals on both a monthly and annual basis and meet reporting guidelines.

Watchdog groups like Charity Navigator monitor the financial reports nonprofits publish and give organizations rankings based on criteria like the percentage of each dollar that goes into their mission (often called the efficiency rating), transparency of financial reporting, expenses and more. Donors, grantors and foundations look to these watchdogs to help them make informed choices about their donations and ensure they’re supporting an organization that is fiscally responsible.

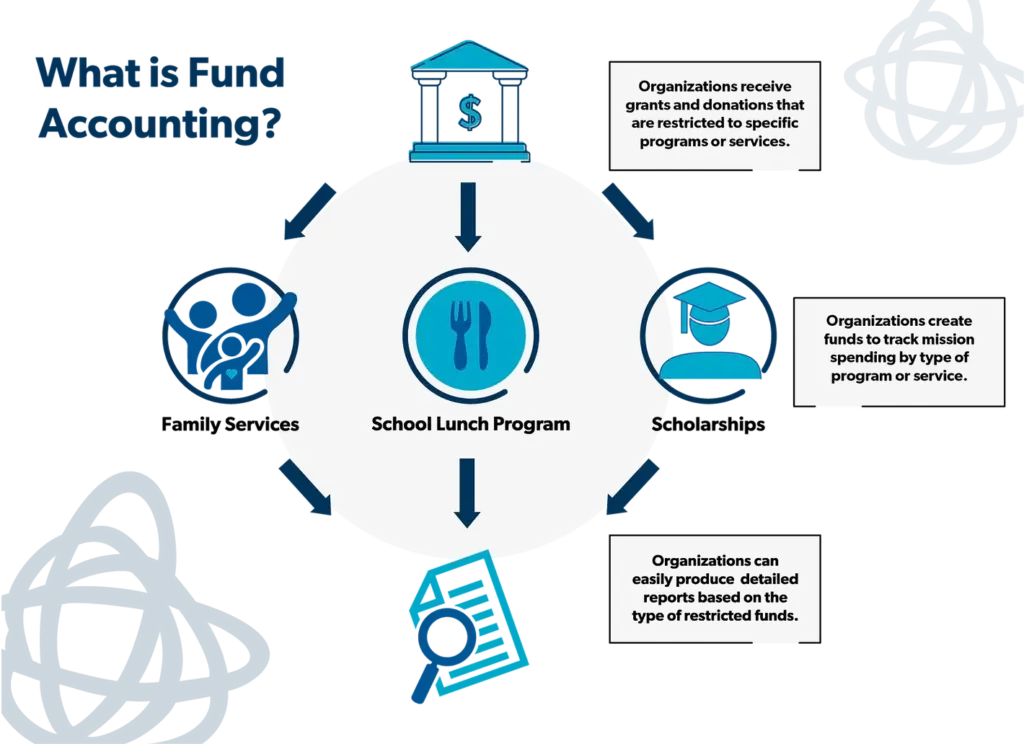

What is Fund Accounting?

Many nonprofits use an accounting approach called fund accounting. This method which focuses on the use of resources more than profitability, with transparency and accountability at its core. It provides the framework for organizations to tell their stories and remain accountable to their stakeholders.

A “fund” is a separate accounting entity that is defined by an organization. An organization may have many funds supporting their mission. Each fund maintains a set of self-balancing accounts that must be used for the specific purpose defined by donors, grantors, governing boards, or by law.

For example, your nonprofit might have a fund for scholarships. You need to ensure that any money raised specifically for scholarships actually goes into scholarship awards. Tracking the amount of funding that goes into a specific program, like scholarships, helps to translate the impact of the funding to donors and other supporters. Instead of only being able to report your overall funding totals, fund accounting allows you can report the total number of students supported, the total dollars that were dispersed, average award size and other key statistics.

Similarly, a grant might have specific conditions like the types of activities it can fund or allowances for overhead expenses. The grant conditions may also have a specific timeline for when funds can be used. Fund accounting allows you to produce reports that ensure your activities match the grant conditions.

The word “fund” has a different meaning at every nonprofit organization. At a university, a fund may be an endowment. At churches, it may be a specific to a mission, congregation or parish. If a church raises money for its building fund, that money may not be spent on other church activities.

Do You Need Fund Accounting and Award Management Software?

Fund accounting is not required by generally accepted accounting principles (GAAP), but nonprofit organizations still need purpose-built fund accounting software. Fund accounting requires specific industry expertise, knowledge and experience to bridge the gap between tracking the use of funds and generating GAAP financial statements that focus on the changes in net assets.

Most accounting solutions lack the ability to maintain balances between funds, recognize the release of restriction and track commitments and encumbrances while supporting the user’s ability to generate transparent, reliable reports at the fund level. Intercompany entries and entity management can’t track fund release and net assets in a manner that is appropriate and tells the complete story.

These tracking requirements can become complicated when your programs are funded by different awards, each with its own timetable and expense eligibility criteria. For international organizations, you may face additional complexity such as handling multiple currencies and multiple languages.

Fund accounting software for grant recipients is often called award management software, or grant management software. You may need to search multiple categories and keywords to learn about all your options. If you are a grantor you may need additional tools to handle the application, award and post-award processes.

How to Choose the Right Software

To find the right product for your needs, the best place to begin is with requirements to help you evaluate alternatives. Here are some common requirements that may apply to your organization.

High Level Requirements

A written list of requirements is the starting point for evaluating accounting software options. Requirements allow vendors to prepare better informed and more accurate proposals in response to your request.

Most organizations seek business benefits from their award management system such as these:

Improve decision making with access to real-time information, expenses, subawards, and obligations, presented in easy-to understand displays.

Increase efficiency. Productivity goes up since information silos are eliminated; everyone has access to the same information reducing time wasting ”back and forth” communications.

Streamline processes. Gives you a comprehensive picture start to finish of your entire process and helps eliminate redundant and potentially conflicting data issues.

Automate, simplify grant compliance. Access one set of data in the format you need as often as you need.

Provide user-defined multi-currency viewing. View and report grant data in different currencies, depending on your multinational operational needs.

Support multiple languages. Specific the languages which you need for all your users.

After you spell out the broad goals for the software, it’s time to delve into the details. You should provide samples of your documentation as appropriate to accompany these requirements. You may want to use a spreadsheet to track how various products stack up in your evaluation.

The following are sample high level requirements:

Category | Requirement |

Security |

|

Hosting |

|

Integrations |

|

Proposals |

|

Awards |

|

Rules |

|

Subawards |

|

Intercompany |

|

Starting with requirements like these, you may end up with dozens more which are unique to your organization. For instance, do you need to comply with any government standards or integrate with additional backend systems? Making the requirements more specific can speed up the evaluation process.

Achieving Compliance with Accounting Standards

The financial manager of a nonprofit must acknowledge the regulatory and compliance environments in which their organization operates. Nonprofit organizations must deliver clear statements to their key stakeholders including donors, board members, auditors, and watchdog groups. This creates several issues for the organization such as the timing of the audit, financial presentation, and the response to a number of due diligence questions typically required by board members or the auditors.

Handling Audits

One of the main benefits of accounting software is to ease the burden of financial audits. CFOs and financial managers use data to find patterns in behavior, identify trends to help plot the best course for their operations and to take advantage of the opportunities good data can provide. Analytics can keep your organization running smoothly amid inevitable operational changes and adjustments. Further, analytics can provide a complete view of the organization, with the appropriate level of detail easily available. Auditors are also using data analytics to support their processes. Analytics can provide higher quality audit evidence, reduce repetitive tasks, and better correlate audit tasks to risks and assertions.

A financial manager must be prepared to respond to the increased demands for more data from donors, the Board, auditors and constituents of the organization and institution the organization supports. Typical periodic reports are no longer sufficient.

Financial Tool Kit

The financial manager of a nonprofit organization must continually evaluate the tools available to their teams to support the audit and operations. The financial team needs tools to respond to compliance changes and support the demands of audits. These tools should include:

An Enterprise approach to business operations that provides a centralized database and system of record

The ability to drill down to underlying data in reports

Oversight to changes made to setup, users, and permissions

Integrated allocation and budgeting processes

Embedded workflow process that restricts access across the data as well as requires appropriate review

Flexible nomenclature that can evolve with the organization

Dimensional reporting

The collection of financial and non-financial data to support the new reporting and 990 filing requirements.

Sylogist’s portfolio of solutions includes accounting software and fundraising software for nonprofit organizations, NGOs and K-12 school districts. Some options also have features to track student information, HR functions and payroll.

One of our experts will reach out to help you learn more about the Sylogist’s solutions.